Pv of bond calculator

Whether Company Z should take Rs. The formula can be again written and presented as the following example.

How To Calculate Bond Price In Excel

5500 is higher than Rs.

. Annual Coupon Rate. An individual is offered a bond that pays coupon payments of 10 per year and continues for an infinite amount of time. In our hypothetical scenario the following assumptions regarding the bond will be used to calculate the yield-to-maturity YTM.

5500 after two years we need to calculate a present value of Rs. Bond sinking funds may help you reduce the final amount to pay by making regular payments - and letting interest do the work for them. This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals eg testing whether the portfolio can sustain the planned withdrawals required for retirement or by an endowment fund.

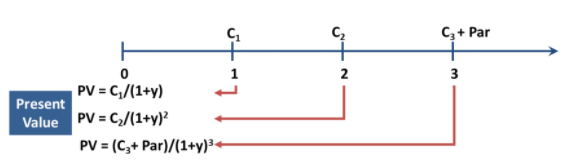

Price of Bond PV. Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. This bond pays John 200 every year.

Example of Zero Coupon Bond Formula with Rate Changes. PV of Perpetuity Calculator Click Here or Scroll Down A perpetuity is a type of annuity that receives an infinite amount of periodic payments. After 5 years the bond could then be redeemed for the 100 face value.

5000 if the present value of Rs. Now in order to understand which of either deal is better ie. 5500 on the current interest rate and then compare it with Rs.

Finding the amount you would need to invest today in order to have a specified balance in the future. The perpetuity series is considered to continue for an infinite period. Face Value of Bond FV.

Number of Years to Maturity. You can also sometimes estimate present value with The Rule of 72. After solving the equation the original price or value would be 7473.

John has invested into a bond which pays him coupon payment for an infinite period of time. PV D 1r D 1g 1r 2 D 1g 2. 5000 then it is better for Company Z to take money after two years otherwise take Rs.

Well also assume that the bond issues semi-annual coupon payments. Present value is compound interest in reverse. A sinking fund is a fund which a company may put the money into from now on to make their debt repayments easier.

Among other places its used in the theory of stock valuation. The most common example is a bond sinking fund used by companies to manage their debt. See How Finance Works for the present value formula.

A 6 year bond was originally issued one year ago with a. 5000 today or Rs. An annuity is a financial instrument that pays consistent periodic payments.

Duration is expressed as a number of years.

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Excel Formula Bond Valuation Example Exceljet

Yield To Call Ytc Bond Formula And Calculator Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate The Current Price Of A Bond Youtube

Zero Coupon Bond Formula And Calculator Excel Template

An Introduction To Bonds Bond Valuation Bond Pricing

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Formula Calculator Example With Excel Template

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Bond Valuation A Quick Review Youtube

Zero Coupon Bond Value Formula With Calculator